Thursday, August 27, 2009

Sunday, July 26, 2009

Contradicting McCulley

To be sure, we are presently living in an unusual world, in that the Fed is pegging the Fed funds rate at effectively zero. But it is not stimulating robust demand for credit, or alternatively, it is not stimulating bankers to gin up demand for credit by loosening terms and conditions to prospective borrowers. Actually, reality is probably a bit of both: reluctant borrowers and reluctant lenders.

In my opinion this is completely wrong. The Fed's policies have indeed stimulated robust supply of (risk-free) credit from the bankers and robust demand for credit by the Treasury. I don't have a chart at hand showing of how much of the Treasury's recent borrowing has been financed by the U.S. financial system, but I trust that it's the bulk of it.

Thus, we can categorically say that the near-zero Fed funds rate is not, for the moment, fueling an inflationary pace of aggregate demand growth relative to the economy’s supply potential. And neither is the Fed’s Credit Easing, which is the proximate cause for the explosion of excess reserves in the system. Yes, in the fullness of time, zero Fed funds could conceptually re-ignite borrowers’ and lenders’ mojo. Indeed, that’s precisely the Fed’s objective. And if and when that objective is achieved, the Fed funds rate will need to be hiked to temper the re-ignited mojo, so as to prevent the economy from overheating.This part is way too keynesian even for McCulley. Kasriel finds a correlation of 0.64 between M2 and inflation, and only 0.08 (!) between the output gap and inflation. Also, look at how inflation flamed up in 1934 while the unemployment rate was in the high teens.

Sunday, June 14, 2009

CR: Option Arms

First post in a long time... CFA exam and all that. From CR:

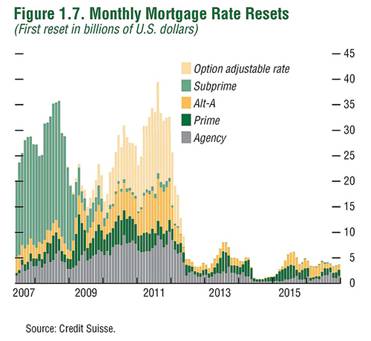

First post in a long time... CFA exam and all that. From CR:And here is a repeat of the most recent reset / recast chart from Credit Suisse.

Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

As Tanta noted: "Reset" refers to a rate change. "Recast" refers to a payment change.

Resets are not a huge problem as long as interest rates stay low, but recasts could be significant. There are some questions about how the Wells Fargo pick-a-pay portfolio fits into this chart, since Wells Fargo doesn't expect significant recasts until 2012 (see A Bank Is Survived by Its Loans )

Tuesday, May 5, 2009

Hussman on valuation

What we can observe is that valuations are now in the high-normal range on the basis of normalized earnings. Stocks are no longer undervalued except on measures that assume that profit margins will permanently recover to the highest levels in history (in which case, stocks would still only be moderately undervalued). For instance, the price-to-peak earnings multiple on the S&P 500 is only about 11, but those prior peak earnings from 2007 were based on record profit margins about 50% above historical norms, largely driven by the excessive leverage that has since sent the economy reeling.

On normalized profit margins, valuations are above the historical average, and prospective long-term returns are below the historical average. Overall, I expect the probable total return on the S&P 500 over the coming decade to be about 8% annually, provided we don't observe much additional deleveraging in the economy. At the 1974 and 1982 lows, based on our standard methodology, the S&P 500 was priced to deliver 10-year total returns of about 15% annually. While it has become quite popular to talk about 1974 and 1982, the stock market is presently not even close to those levels of valuation.

Monday, April 6, 2009

So...

These are indexes designed to track the prices for non-agency residential mortgage-backed securities. Apparently, the stock market did not pay attention.

Monday, March 30, 2009

Mortgage resets

Since this crisis began, the profile of mortgage resets has been well-correlated with subsequent foreclosures. . . .

As the recent housing bubble progressed, the profile of mortgage originations changed, so that at the very peak of the housing bubble, new originations took the form of Alt-As (low or no requirement to document income) and Option-ARMs (teaser rates, with no required principal repayments).A broader profile of mortgage resets is presented below (though even this chart does not include the full range of adjustable mortgage products).

This reset profile is of great concern, because the majority of resets are still ahead. Moreover, the mortgages to which these resets will apply are primarily those originated late in the housing bubble, at the highest prices, and therefore having the largest probable loss.

Sunday, March 29, 2009

Tuesday, March 24, 2009

More on Existing Home Sales

by CalculatedRisk on 3/23/2009 10:20:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in February 2009 than in February 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in February 2009 than in February 2008.Again - a significant percentage of recent sales were foreclosure resales, and although these are real sales, I think existing home sales could fall even further when foreclosure resales start to decline sometime in the future.

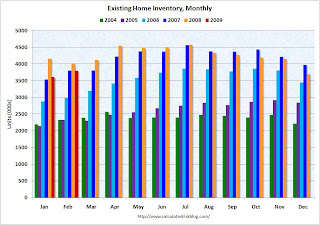

The second graph shows inventory by month starting in 2004.

The second graph shows inventory by month starting in 2004.Inventory levels were flat during the bubble, but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been below the year ago level for the last seven months. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some REOs being held off the market.

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time.

A large percentage of existing home sales (40% to 45% according to the NAR) are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This graph shows existing home sales (left axis through February) and new home sales (right axis through January).

This graph shows existing home sales (left axis through February) and new home sales (right axis through January).For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

I think the keys to watch for the housing market are declining inventory levels, a bottom in new home sales, and the gap between new and existing home sales closing.

Tuesday, March 10, 2009

Money Supply

I am writing to you with reference to the latest Econtrarian, in which you explain that a decrease in the amount of stocks that an individual buys as a proportion of its income does not lead to an increase in the money supply since "XYZ’s bank account is debited by the same amount that the employee’s bank account is credited. No new money is created in this process. All that has happened is that the ownership of money has changed".

I can try to extend the argument to the case where an individual sells previously owned stocks and decides to hold the proceeds in her bank account: since there has to be a seller for every buyer, the seller's bank account will decrease by the same amount as the increase in the buyer's account, and so no net new money has been created.

However, I am wondering what you think about the case where someone sells stocks to a foreign buyer (which is likely to have happened in the recent past, as holdings of foreign equities by U.S. investors have decreased significantly). Then, could it be that the U.S. money supply has increased in the process, while matched by an equal decrease in the money supply in the foreign buyers' countries? This could lend support to Asha Bangalore's February 19th argument that "Inflation adjusted money supply is advancing because currency, demand and saving deposits have risen sharply. At the same time, bank lending has contracted", which otherwise would be at odds with your view.

And here is his answer:

Unless the foreign buyer borrowed dollars to purchase the dollar-denominated stock or bond, there is no increase in the U.S. money supply. If no borrowing occurred, then the foreign buyer would have to purchase dollars in the forex market to pay for the stock/bond purchase, which, again, just changes the ownership of dollars but does not increase the supply. The foreign purchaser of stocks/bonds presumably purchases the dollars with her own currency, which changes the ownership of that currency.

I have to admit that I am perplexed as to why the U.S. money supply, excluding currency and retail money market shares, is increasing as rapidly as it is when bank credit and bank assets are declining. Assets equal liabilities plus net worth. With commercial bank assets declining in recent weeks (assets soared back in October due to JP Morgan's assumption of WAMU, a savings & loan), then liabilities plus net worth also must be declining. If net worth and other liabilities are declining, then it would be possible for deposits to be rising even though total assets are falling. The data indicate that this is what is happening. But I still do not understand the process by which this is occurring. I am skeptical that advances in the money supply are as "stimulative" as otherwise when bank assets and bank credit are contracting.

Paul

If anyone believes they can contribute to the discussion, feel free to do so.

Saturday, March 7, 2009

Gross' keynesian framework starting to show its limits

Trillions will be required in the U.S. alone and it is critical that there be a high degree of policy coordination among all nations, which avoids protectionist measures reflective of failed policies in the 1930s. To date, PIMCO’s Mohamed El-Erian’s imperative of “shock and awe” has been more like “don’t bother us, we’re working on it.” Get moving. Risk being bold – Washington.http://www.pimco.com/LeftNav/Featured+Market+Commentary/IO/2009/Investment+Outlook+Bill+Gross+March+2009+Hairy+Lips+Sink+Ships.htm

(...) Global willingness to accept American dollars is being tested. Granted, the U.S. currency has appreciated strongly against its counterparts during most of this crisis, but technical short covering as opposed to a flight to quality may have been the dominant consideration. Watch the dollar. If it falls hard, there may be nothing policymakers can do to restore the ensuing financial chaos.

Friday, March 6, 2009

More Russell

On July 8, 1932, the Dow sunk to its final bear market low of 41.22.

As soon as the Dow passed that low, volume on the NYSE suddenly soared to 4-5-6 million shares as the market surged higher. A new bull market had started amid the Great Depression. At that time, nobody had any money. The nation was broke. And yet when the market following July 8 turned from bear to bull, volume exploded. The market in its amazing wisdom, immediately recognized the turn. And from a "broke America," money poured into Wall Street as volume on the NYSE surged. I always wondered where that money came from -- wasn't it remarkable -- and it is a lesson I'll never forgot. When the price is right, the money will be there.

Friday, February 27, 2009

Richard Russell

Which is why I've recommended gold coins. In a funny way, once you buy some coins you are stuck with them. It's so much trouble to buy the coins, that once you buy them and take physical delivery, you tend to sit with them. It's even more trouble to sell the coins so again -- you sit with them. Over time, those who bought the coins and have sat with them -- have done best in the gold bull market. They never traded in and out of the bull market, and they necessarily stayed with the great primary bull trend in gold. In other words, by "doing nothing" they did well.I'm glad to be able to say "they" applies to me.

Monday, February 23, 2009

Soros a tendance à mélanger ses opinions politiques et ses prévisions...

NEW YORK (Reuters) - Renowned investor George Soros said on Friday the world financial system has effectively disintegrated, adding that there is yet no prospect of a near-term resolution to the crisis.

Soros said the turbulence is actually more severe than during the Great Depression, comparing the current situation to the demise of the Soviet Union.

He said the bankruptcy of Lehman Brothers in September marked a turning point in the functioning of the market system.

"We witnessed the collapse of the financial system," Soros said at a Columbia University dinner. "It was placed on life support, and it's still on life support. There's no sign that we are anywhere near a bottom."

C'est la pire crise depuis des décennies, plus rien ne sera pareil, etc... tout le monde le sait. De là à comparer avec la chute de l'URSS... il reste quand même 80% de l'économie mondiale qui est productive. D'accord il y a encore de nombreux dominos qui vont tomber, par exemple on entend beaucoup parler des filiales des banques ouest-européennes en Europe de l'est (en général les choses arrivent avant que les journaux en parlent). Malgré ça il ne faut pas sous-estimer le pouvoir de relance de dépenses publiques (mondiales) astronomiques, qui plus est financées par la planche à billet (ce qui aura ses conséquences mais c'est un problème pour 2011-2012). Il manque encore un dernier ingrédient qui est la restructuration des bilans des ménages US (seulement 75 milliards, il en faudrait dans les 500). Cela faisait partie du plan de Bernanke en... 2007, mais apparement la pillule à du mal à passer:

http://www.youtube.com/watch?

Saturday, February 14, 2009

Tuesday, February 10, 2009

Kasriel: The Great Depression – Just the Facts, Ma’am

(...) the hurdles that today’s economy has to jump over to enter a recovery would appear to be much lower than the hurdles that were erected between 1930 and 1932.

In addition, the federal government is about to embark on a massive fiscal stimulus program. Will the Fed monetize much of the new debt issued to fund this program? We do not know yet. But if recent history is any guide, the answer is yes. Chart 7 shows that the growth in bank reserves in 2008 was almost 149% – an unprecedented increase. If the federal government embarks on a large spending spree and the Fed “prints” the money to fund the spending, then the pace of real economic activity is bound to increase. How long it will take for higher prices to begin to erode real activity is another question. But never underestimate the initial positive impact on aggregate demand of that powerful combination of increased federal government spending/tax cuts and a central bank running the monetary printing press at a high speed.

The economic data are likely to be abysmal through the first half of this year. The popular media will reinforce the gloom of the data. The same pundits who did not see this downturn coming will not see the recovery coming either. My advice to you is to keep your eye on the index of Leading Economic Indicators. If history is any guide, the LEI will signal a recovery well ahead of the pundits.

I plan on developing an enhanced version of the LEI for my Master's dissertation for a reason.

Monday, February 9, 2009

Hussman: market internals have gotten a bit better

We've observed a small favorable divergence between the major indices and overall market breadth in recent weeks, as investors have begun to pick the wheat from the chaff. There is no assurance that this process will continue, (...) however, it's a good sign to observe investors being more discriminating about investment quality, because it allows investment returns on the basis of stock selection, without relying on sustained gains in the overall market.

Barron's Magazine

Tuesday, February 3, 2009

January Senior Loan Officer Survey Includes Many Positive Aspects

January Senior Loan Officer Survey Includes Many Positive Aspects

Asha G. Bangalore, Northern Trust Global Economic Research

February 2, 2009

The Senior Loan Officer survey of January 2009 contains many noteworthy aspects that bear good tidings. There were fewer bank officers reporting they had tightened loan underwriting standards for commercial and industrial loans for both small and large firms in January compared with December (see charts 1 and 2). The fact that some bank officers have eased mortgage underwriting standards is notable but the levels still exceed the peak reported in 2001 (see charts 1 and 2). In the case of both large and small firms, the demand for loans was weaker in January compared with December. Although the history of these data is short, in 2001, the demand for loans turned around only after the recession had reached its last leg, where as the peak for the number of banks reporting tightening standards peaked slightly ahead.

This is one of the first indicators to point towards a recovery.

Sunday, February 1, 2009

Citigroup: Ward of the State

I've heard many times a recommendation to "buy what the government is supporting." But I suggest investors take an alternate but similar approach. In the bond market, buy what the government is supporting to maintain liquidity, not what the government is supporting to avoid insolvency. There is now, or may be in the near future, strong government support of several bond sectors that would be money good anyway, but are trading cheap because of poor liquidity. Student Loan-backed bonds, municipal bonds, GSE-backed mortgages, etc. Why are people buying Citigroup bonds at around 6% yield with so much uncertainty surrounding it?

Citigroup is clearly a declining situation. It may well be that with government support, Citi survives and eventually becomes a thriving company again. But its also distinctly possible that in a break-up, bond holders are left with something less than full government support. Buyer beware.

The Alternative Universe Newswire

Thursday, January 29, 2009 at 9:21 AM Posted by Macro Man

There is a theory in particle physics, known as the many-worlds hypothesis, which posits that there are an inifinite number of universes, with a new one created whenever a particle's qunatum wave function "collapses." Readers of Philip Pullman's His Dark Materials trilogy will be familiar with one "practical" interpretation of the hypothesis, wherein similar but slightly different universes overlap each other.

Macro Man can confirm that this is in fact the case, as he possesses a rather unique newswire that feeds in from one of the alternative universes. He usually keeps it under wraps in the bottom of a drawer, but sometimes feels compelled to have a look at it when real-world news headlines leave him scratching his head. He finds that the alternative universe newswire sometimes offers a fresh, more truthful perspective on events than his everyday sources of news.

Recently, he's taken to looking at the alternative newswire with depressing frequency. Consider the following real-world headlines that have crossed his screen recently, and compare them with the alternative-universe newsfeed:

Our world newsfeed(OWN): Russia, China blame woes on capitalism

Alternative world newswire (AWN): Wen, Putin admit Martingale forex strategies "misguided".

In gambling, a Martingale strategy is one in which one's stake is doubled after every losing bet until he finally wins (or loses all his money.) If one possesses infinite wealth, this strategy will deliver a profit of the original stake when one finally wins; in the real world, however, its practitioners usually bust before finally winning.

In markets, the term refers to adding to a losing trade to "improve your average". Unsurprisingly, market punters usually achieve similar results to roulette players in using the strategy.

And in macroeconomics, it has come to mean an endless cycle of buying foreign exchange reserves to maintain an artificially weak exchange rate, regardless of the negative externalities of such a policy. To be sure, the US is culpable for a great deal of the current global economic stress, but this does not absolve either China or Russia for pursuing their own misguided policies which have generated a collosal misallocation of resources.

That the ongoing travails of the rouble has impaired the kleptocrats' financial standing in some small degree provides at least one small rainbow in an otherwise never-ending torrent of doom and gloom.

OWN: Brown says UK was right to sell gold in 1999, says UK bought euros by selling gold

AWN: Brown admits selling XAU/EUR below 300 was "collossally stupid"

The high print in XAU/EUR in 1999 was 270. It is now 632. Macro Man isn't sure what is worse: that Gordon Brown is too stupid to understand that that is a bad trade, or that he thinks that YOU are too stupid to understand that that is a bad trade. OWN: "We foresaw economic downturn," Trichet says.

OWN: "We foresaw economic downturn," Trichet says.

AWN: Trichet reveals ECB forecast model (pictured, below.)

AWN: Brown admits that UK is buggered

OK, maybe it's not fair to pick on Gordon twice. But the gold headline above was literally unbelievable, and the graphic below (which amde the rounds yesterday) is too good not to share.

Thursday, December 4, 2008

Tanta's posts

http://calculatedrisk.blogspot.com/2008/12/compendium-of-tantas-posts.html

Thursday, November 13, 2008

Cliff diving*

The Markit ABX-HE indexes are posting new lows. While most market participants have their eyes on such symptoms as the LIBOR rates and spreads, I like to look at the prices of the (asset-backed) securities that are at the origin of the illness:

http://www.markit.com/information/products/category/indices/abx/history_graphs.html

Tuesday, November 4, 2008

TIPS

Here is an extract from an e-mail discussion I had with MarketWatch's Mark Hulbert, following his post on the subject:

(...) without any adjustment the 5-year TIPS currently embodies a zero inflation rate, and the 10-year carries very small 15 bps implied inflation rate (http://www.bloomberg.com/Well to be precise there are still many risks involved in investing in TIPS even at these prices: there could be more forced sales driving the yields up/prices down, an expanding liquidity risk, or rising real interest rates. But my point is that the risk/reward is extremely favorable.markets/rates/index.html ).

But I don't think that in current market circumstances we should view this as what the bond market expects inflation to be in the future. It is more likely that the same technical factors that have forced down the value of nearly every financial asset in the past few months have been at play here.

Actually when you think of the fact that the Treasury will not take back money from the holder of TIPS if the CPI turns out to be negative, then TIPS are selling at a pretty amazing value here. The risk/reward is simply not symmetric: if the CPI is zero or above you'll make as well or better than in conventional notes, and if the CPI is negative... you won't make less.

Raphael

Tuesday, August 12, 2008

"Never sell America short"

I have doubts. For several small reasons: the same as everyone else's (BRICs and the European Union for example) and my own (the 24 percent dropout rate in California highschools and the reticence of conservative politicians to engage the country more profoundly in biotech research because of religious views come to mind, but there are many others).

But my doubts arise mostly for the following reason: the still persistent triumphalism of some important circles of the country's elite, and most notably the Federal Reserve. Not just the FOMC, but just as importantly the research team (composed of some of the most talented economists in the world) which provides the basis for the Fed's analysis and policy, and also influences Congress, the White House, think tanks, you name it. When one of them tries to raise his voice, he is rarely listened to (think Poole on the GSEs many years ago).

The trigger for my posting this was reading a new paper by Carol C. Bertaut, Steven B. Kamin, and Charles P. Thomas (How Long Can the Unsustainable U.S. Current Account Deficit Be Sustained?). Their conclusion: "All told, it seems likely it would take many years for the U.S. debt to cumulate to a level that would test global investors’ willingness to extend financing." (Funny, the absolute level of the dollar and the fact that long-term Treasury rates relative to the past few years are still high despite the economic downturn would argue otherwise). Since I didn't really care for their model (it's a partial-equilibrium) or their conclusion for that matter, I jumped to the assumptions that they used to project the income balance. The income balance is the difference between the US foreign assets returns and the rest of the world's returns on their claims in the US (the net share of US production that is sent abroad as dividends or interest income).

I found exactly what I was expecting to find (p. 9): "(...) the rates of income on U.S. private portfolio assets and liabilities have been roughly similar in recent years and are projected to remain so, at a level close to the projected U.S. short-term rate of interest, going forward." It continues: "Historically, income rates on U.S. direct investment abroad have exceeded that on foreign direct investment in the United States. Although this gap has narrowed over the past decade, it remains large and we project it to remain large in the future." Why would that be? The answer is on footnote 6: "A number of explanations have been advanced for the asymmetry of rates of return on direct investment, including greater efficiency of U.S. firms, better project selection by U.S. firms, younger and thus less mature investments for foreign firms in the United States, greater competitive pressures in the U.S. market, or differences in tax treatment. (See Higgins, Klitgaard, and Tille, 2005.) None of these factors seem likely to disappear in the near term."

Naturally, none of these factors seem likely to disappear and I won't even try to argue why they probably will. The point is that none of these factors have actually been proved to be the reason of the persistently low income deficit of the US. As it has been argued by many authors, these factors are actually smoke and the true reasons behind the low income deficit are: poor balance of payment accounting and reconciliation, and/or statistical flukes, and/or temporary beneficial movements in rates, and/or difference in tax treatment of direct investment. This latter factor is actually cited by Bertaut et al. but the authors don't state, or take into account in their model, that this makes the income balance look better than it actually is! (For a review of the reasons behind the "mysteriously" low income deficit and net debt of the US, see my 2007 paper).

The point of this post is not to point out a misargument in Bertaut et al. paper. I just wanted to show, using a subject that I am familiar with (the US BoP), the wrong attitude of the governing elite of the US. In their analysis, these influent intellectuals very often use optimistic (sometimes overly so) assumptions. I will turn long-term bullish on the US once I can see that it does what the wise man advised: "prepare for the worst, hope for the best". What I see today would be more along the lines of "prepare for the best, if the worst comes... who could have known?"

Sunday, July 6, 2008

Commodities: just speculation?

This chart shoes that non-exchange traded commodities have generally outperformed exchange-traded commodities, for which there is supposedly much more speculation (margin trading, futures, options, ETFs...). Thus it strongly refutes the theory that the current bull market is based mostly on speculation. Not that speculation doesn't have a part -- it always has (especially in the past few months).

Saturday, May 12, 2007

My paper is online!

http://www.fileden.com/files/2007/5/12/1072901/On%20the

%20behaviour%20of%20U.S.%20foreign%20balances.pdf

If anyone knows a better way (more direct) to host files online, let me now.

I'll try to post a few comments on the markets and the economy from time to time.