Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in February 2009 than in February 2008.

Again - a significant percentage of recent sales were foreclosure resales, and although these are real sales, I think existing home sales could fall even further when foreclosure resales start to decline sometime in the future.

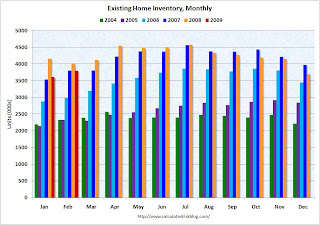

The second graph shows inventory by month starting in 2004.

Inventory levels were flat during the bubble, but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been below the year ago level for the last seven months. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some REOs being held off the market.

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time.

A large percentage of existing home sales (40% to 45% according to the NAR) are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This graph shows existing home sales (left axis through February) and new home sales (right axis through January).

For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

I think the keys to watch for the housing market are declining inventory levels, a bottom in new home sales, and the gap between new and existing home sales closing.